By Julianne Geiger – Apr 20, 2020, 5:00 PM CDT

Oil price futures slipped into negative territory on Monday – a shocking oil-market first – making previous doom and gloom forecasts of OPEC’s too-little-too-late production cuts now seem like sober predictions rather than overzealous fearmongering.

But are negative oil prices here to stay?

A First Time for Everything

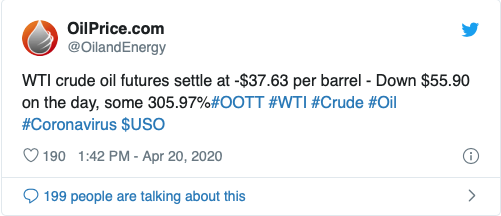

WTI crude oil futures settled at -$37.63 per barrel on Monday, down $55.90 on the day. Not only was it the largest price drop for the commodity in history at some 305.97 percent, but it was also the first time that the WTI futures market fell below $0.

While everyone agrees that the oil market has been battling multiple enemies over the last couple of months – namely storage limitations, overproduction, and low prices – today’s redline move was brought about by another enemy: poor timing.

Speaking of Time

The sharp drop into negative territory for oil futures was brought about by more than “just” storage limits and overproduction. It’s about the timing of future contracts.

$USO and the CLK20

The United States Oil Fund LP (NYSEARCA: USO) – an ETF for crude – undeniably instigated the historic decline in May WTI futures’ today. The reason? Because the futures contract expires on Tuesday.

Related: Oil Prices Hit $1 Following A 90% Crash

Bloomberg sources suggest that as of last week, the USO held 25 percent of the outstanding shares of May 2020 WTI oil futures. But that contract will end tomorrow.

Buyers of these contracts must either sell these contracts for oil now or take physical delivery of the oil at the end of May. Of course, an ETF like the USO who deals in paper barrels is not eager to take physical delivery of any amount of oil – even if they could find somewhere to store it.

The result? They must dump their oil, and they must do it now, no matter what the price.

And for those who normally would be willing to take delivery of it, such as refineries and airlines, the stay-at-home orders have pretty much ensured that they don’t want this May contract oil either.

So What Now?

No, the negative oil prices do not mean curtains for the oil industry.

The proof that USO – and other ETFs – are behind today’s plunge can be seen by looking at the June 2020 contract, which although sharply down, is only sharply down in terms of double – not triple – digits.

CLM20 was down 16 percent today versus CLK20’s 309 percent. That June future contract is still trading above $20 per barrel. While this price isn’t necessarily impressive, it is still more than $40 per barrel over May 2020 futures.

This June contract expires May 19 and is a better representation of the true oil market.

This is best depicted by the spread between the two contracts, which is now the widest in history. This widespread indicates not that the oil market is dead in the water, in which case the negative prices would be seen across the June contract as well, but that the market experienced a one-off event that effected the closest month’s prices more profoundly than the next month’s contract prices.

Premium: Oil Isn’t Ready To Rally

Spot prices for WTI also fell today, by nearly 300 percent to -$37 per barrel. It is also the first time in history that WTI spot price has fallen below $0, rounding out the day of rather exaggerated oil-market firsts. The spot price fell into the red as real storage limits continue to breathe down the industry’s neck. If sellers could store the oil somewhere, they would put it away until lower prices rebound. But without available storage, and without wanting to shut down production which is a costly endeavor that is more complicated than flipping off a light switch, producers are willing to buyers to take the oil off their hands.

While today’s oil price developments may not be as bleak as they seem, there is still trouble ahead for the oil industry. U.S. drillers shed 260 rigs in five weeks and are expected to continue. Storage is filling up, demand is drying up, and supply has yet to be willfully restricted. And stay-at-home orders in the United States aren’t set to be lifted for another month in most states, at the absolute earliest.

By Julianne Geiger for Oilprice.co

Leave a Reply